|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Who Does FHA Streamline Refinance and How It WorksThe FHA Streamline Refinance is a program designed to help homeowners with existing FHA loans reduce their interest rates and monthly payments. This process is beneficial for those looking to refinance quickly and efficiently without the usual hassle of appraisals and extensive credit checks. Eligibility CriteriaTo qualify for an FHA Streamline Refinance, borrowers must meet certain criteria set by the Federal Housing Administration. These requirements are designed to ensure that only eligible homeowners can take advantage of the benefits offered by this program. Current FHA Loan HolderOne of the primary requirements is that the homeowner must currently have an FHA loan. This program is exclusively available to those with existing FHA mortgages. On-Time Payment HistoryBorrowers must have a history of on-time payments, specifically, they need to have made the last six months' payments on time. Furthermore, they can have no more than one late payment in the past year.

Benefits of FHA Streamline RefinanceThe FHA Streamline Refinance offers several key benefits that make it an attractive option for eligible borrowers. No Appraisal RequiredOne of the significant advantages of the FHA Streamline Refinance is that it does not require a home appraisal. This can save time and money for homeowners. Reduced DocumentationAnother benefit is the reduced documentation requirement. Borrowers are not required to provide proof of income or employment, simplifying the process significantly. Homeowners who qualify for the FHA Streamline Refinance can also explore FHA first time home buyer loan options if they're considering purchasing a new property after refinancing. Understanding the ProcessThe FHA Streamline Refinance process is straightforward and designed to be completed quickly.

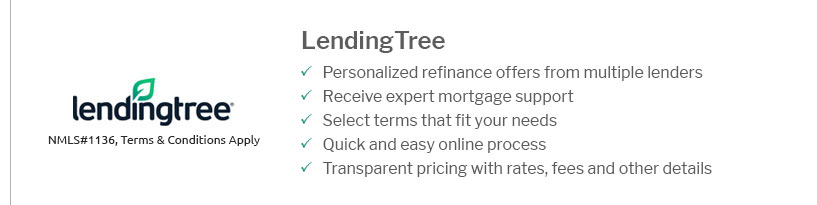

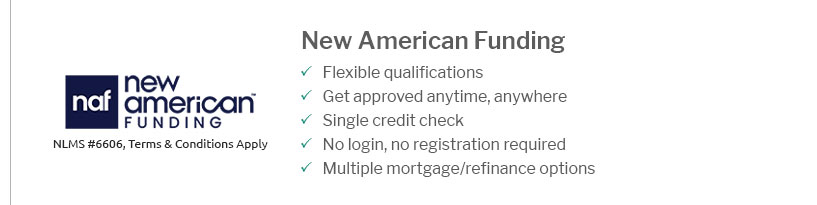

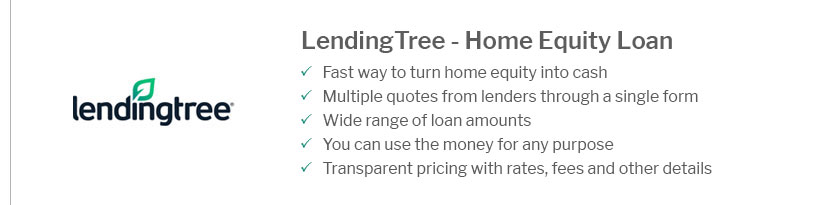

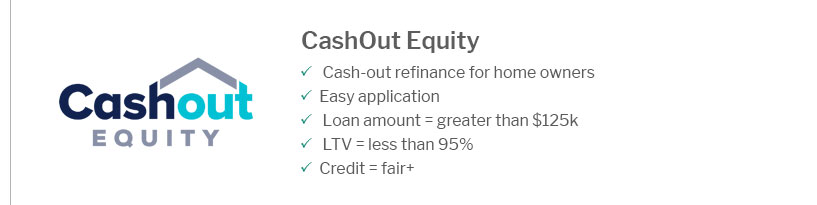

Lender SelectionChoosing the right lender is crucial for a smooth refinancing process. It's essential to shop around and compare rates and terms to find the best deal. FAQWhat is the main advantage of an FHA Streamline Refinance?No appraisal is needed, which simplifies the process and reduces costs for the borrower. Can I include closing costs in the new loan?Yes, it's possible to include closing costs in the new loan if the lender allows it, making it easier to manage expenses. Is an appraisal ever required in an FHA Streamline Refinance?Typically, no appraisal is required, but lenders may require one depending on their policies. Can I access cash through this refinance?No, the FHA Streamline Refinance does not allow for cash-out, focusing instead on lowering monthly payments. For those living in Arizona, the first time home buyer programs arizona might offer additional benefits and resources for new homeowners or those looking to refinance their existing loans. https://www.loandepot.com/home-loans/fha-loan/streamlinerefinance

Basic Guidelines for a Streamline Refinance: The loan to be refinanced must be an FHA mortgage; Current mortgage payments cannot be delinquent ... https://www.pennymac.com/blog/what-is-streamline-refinancing

While FHA Streamline options are the most common, other types of government-backed loan programs also offer Streamline Refinance options with ... https://www.quickenloans.com/home-loans/fha-streamline

FHA Streamlines lower your monthly mortgage payment by either reducing your interest rate or extending your repayment term.

|

|---|